Transfer Concierge

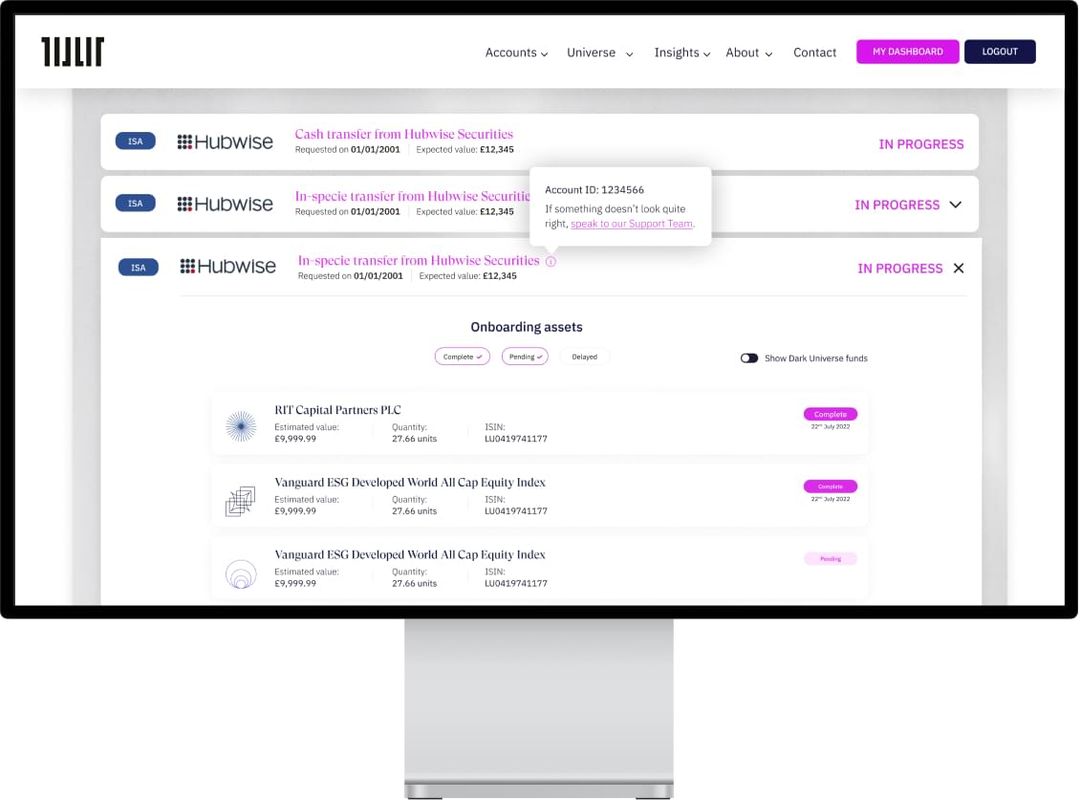

Have a Stocks & Shares ISA or General Investment Account on another platform? We have a Transfer Concierge service, allowing you to transfer to TILLIT in just a few simple steps.

Transfer to TILLIT as cash or bring your existing holdings across, whichever is best for you. And don’t worry, we'll keep you in the loop every step of the way.

Capital at risk. Tax treatment depends on your individual circumstances and may be subject to change.

The Dark Universe

You may not want to be out of the market during the time of a transfer, you may be particularly fond of some holdings in your portfolio that don’t currently exist in the TILLIT Universe, or the timing might not be right to sell. Whatever the reason, we have built the Dark Universe so that you can move to TILLIT and bring your holdings* with you.

*Subject to eligibility

Quality over quantity

TILLIT is built and backed by investment specialists. Our investment universe of funds, investment trusts and ETFs has been thoughtfully curated by industry experts with over 100 years of cumulative experience in fund management and fund selection. Invest in a range of asset classes, regions and styles, in active or passive funds, from over 40 different asset managers.

Unique insights and tools

Whether you have been investing for years or are just getting started, you can find the right funds for you. Our insights are written in plain English by experts, and our unique tools and filters help you find funds that fit your views and goals. Invest with confidence, conviction and ease - invest with TILLIT.

Ready to transfer?

You can transfer your account to TILLIT in cash or in specie in just a few steps. And don't worry, we'll keep you in the loop every step of the way.

Capital at risk.

Frequently Answered Questions

We have put together the answers to the most common questions about transfers. If you have a question you can't find an answer to, please get in touch with our friendly customer team using this contact form.

What is a cash transfer?

If you have a Stocks & Shares ISA, a General Investment Account (GIA) or a pension on another platform, you can transfer it to TILLIT. By transferring your account to TILLIT as cash, your existing provider will sell down any holdings in your account to cash before transferring it to TILLIT.

Once your transfer has completed, you can login and find your cash will be available on your TILLIT Dashboard, ready to be invested.

What is an in specie transfer?

An in specie transfer is the process of transferring assets you hold as they are from one provider to another, instead of having to sell them and transfer the cash proceeds. You remain invested throughout the transfer.

What type of account can I transfer to TILLIT?

- Stocks & Shares ISAs

- General Investment Accounts (GIAs)

- Pensions

How long does it take to transfer my account to TILLIT?

You can start transferring your account to TILLIT in less than 5 minutes! Once we have received your transfer request, we will reach out directly to your existing provider to let them know that you want to transfer your account to TILLIT.

Cash transfers typically take a few working days to complete and an in specie transfer typically takes 4-8 weeks to complete, depending on your current provider and the complexity of your account. Please note, pension transfers can take up to 12 weeks to complete but our Transfer Concierge team will keep you in the loop every step of the way.

Your existing provider may reach out to you to confirm that you want to transfer, so keep an eye out for any communications in the days after you submit your transfer request on TILLIT to avoid any delays.

Can I contribute to my Stock & Shares ISA while it’s in transfer?

Unfortunately not. The reason for this is to make sure that you don’t contribute to two different Stocks & Shares ISAs in the same tax year by mistake. But as soon as your transfer has completed, you are free to make contributions again.

Do I need to do anything before I transfer my account to TILLIT?

To avoid any delays with your transfer, please make sure that your personal details are up to date with your existing provider, including your address.

Are there any fees associated with transferring my account?

We won’t charge you any fees to transfer your account to (or from!) TILLIT. However, your current provider may charge exit and/or dealing fees. The costs and charges are dependent on your current provider.

Please note that some providers charge higher dealing fees if they make sales on your behalf, as opposed to you instructing the sale yourself. You should confirm dealing charges with them if you have any questions ahead of your transfer.

Please note that if you are transferring a General Investment Account in cash, or in specie and hold investments that TILLIT cannot accept, you may also incur a Capital Gains Tax charge as a result of those investments being sold down to be transferred as cash.

Tax treatment depends on an individual’s circumstances and may be subject to change.

Regulated and FSCS protected

TILLIT Limited is authorised and regulated by the Financial Conduct Authority (FCA). Our custodian, Seccl Custody Ltd, is also authorised and regulated by the FCA, and any eligible deposits are protected (up to £85,000) by the Financial Services Compensation Scheme.